Whoa! So, I was messing around with my Solana setup the other day, and something felt off about how folks pick their validators. I mean, you’d think it’s straightforward—just pick the highest staked node and call it a day, right? Nope. Turns out, validator selection is a bit like choosing a good mechanic in a small town—trust matters, but so does transparency. And that’s where Solana wallets and SPL tokens come in, shaking things up in ways you might not expect.

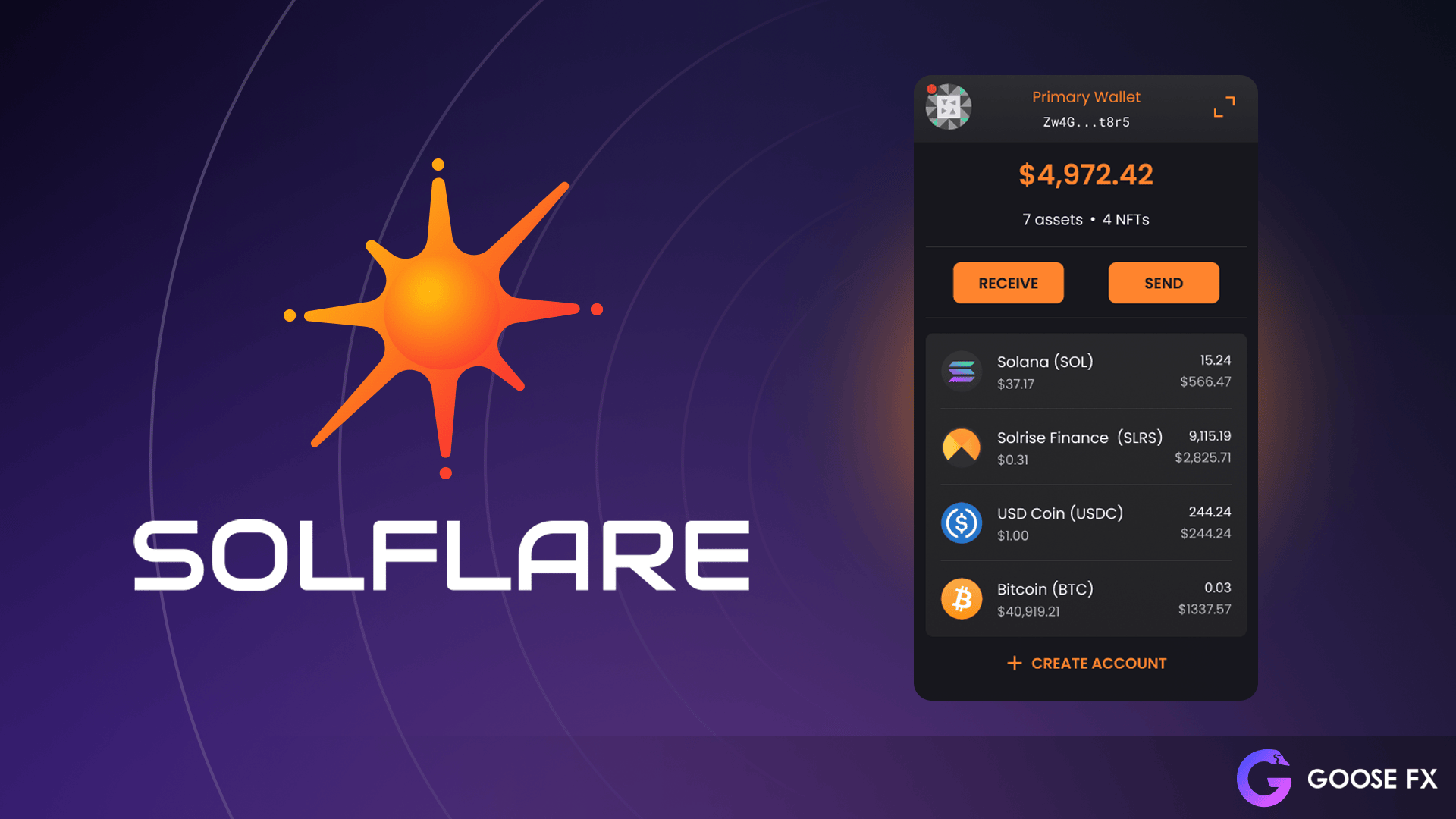

First off, if you’re deep in the Solana ecosystem, you probably know that your wallet isn’t just a place to stash crypto. It’s a gateway to staking, DeFi, and even governance. But here’s the kicker: not all wallets are created equal. Some make validator selection a total headache, while others streamline the process. I’m biased, but Solflare’s interface makes this way easier. If you haven’t checked it out yet, the solflare wallet download is legit and user-friendly.

Okay, so here’s the thing—SPL tokens are the lifeblood of Solana’s DeFi ecosystem. They’re like ERC-20 tokens on Ethereum but with Solana’s signature speed and low fees. What’s wild is how these tokens interact with staking and validators. Some decentralized apps use SPL tokens to represent staking shares or voting power. This means your wallet doesn’t just hold tokens; it’s actively shaping network security through your choices.

Hmm… initially, I thought staking was just a passive act—lock your tokens, earn rewards. But on one hand, your validator choice impacts network health and decentralization. On the other, you want the best ROI. Balancing these feels tricky. Actually, wait—let me rephrase that. It’s more like walking a tightrope between earning and ethics, which most wallets don’t make obvious.

Here’s what bugs me about many interfaces: they show you a list of validators with percentages and rewards, but that’s about it. No real context. Who’s reliable? Who’s been offline? What’s their community reputation? Solflare, on the other hand, offers transparency tools that give you a richer picture, helping you avoid sketchy validators that could jeopardize your stake.

Validator Selection: More Than Just Numbers

Seriously? Picking a validator feels like a high-stakes game. You’ve got to consider uptime, commission rates, and even the operator’s ethos. Some validators are known for being super reliable but take a bigger cut. Others are low commission but occasionally drop the ball. And, oh man, if your validator goes offline too often, your rewards tank. That’s why the wallet interface matters so much.

Using SPL tokens can sometimes muddy the waters. For example, some staking pools issue SPL tokens representing your stake, which you can trade or use elsewhere. This liquidity is cool but adds complexity. If the pool’s validator misbehaves, that might affect token value too. So your wallet has to track these nuances seamlessly.

Check this out—when I first staked via Solflare, I noticed how it aggregates validator stats and ranks them intuitively. My instinct said, “This is the one.” I didn’t have to dive through raw data or external explorers. It’s a subtle but massive quality-of-life improvement.

Though actually, there’s a catch. Not all validators are equal in terms of decentralization goals. Some have tons of delegated stake, which centralizes power, risking network health. The wallet’s role here is educational—making users aware of these dynamics so they’re not blindly chasing yield but also considering the bigger picture.

Oh, and by the way, for folks juggling multiple SPL tokens and staking positions, having a wallet that integrates all these features under one roof saves so much time and reduces mistakes. And mistakes in crypto can be costly—trust me on that.

Why the Solflare Wallet Stands Out in the Crowd

Okay, so I’m not just throwing shade at other wallets for no reason. From personal experience, Solflare nails the balance between usability and power-user features. They’re not perfect, but the team clearly understands the Solana ecosystem’s quirks. For example, they support direct staking within the wallet, letting you pick validators, monitor performance, and even claim rewards without hopping around apps.

Honestly, the integration of SPL token management alongside staking tools blew me away. You get a dashboard that feels like it was designed by someone who actually uses Solana, not just a coder churning out features. Plus, the security measures—like hardware wallet compatibility and encrypted seed phrases—are top notch.

Here’s a little tidbit: I’ve seen wallets that don’t update validator info in real-time, which left me guessing if my stake was active or frozen. With Solflare, updates are prompt, which gives a sense of control and peace of mind.

Still, I’m not 100% sure if Solflare covers every edge case, especially for institutional stakers with complex needs. But for everyday users diving into DeFi or staking SPL tokens, it’s a solid bet.

So if you’re looking to get started or want a better handle on your validator choices, the solflare wallet download is worth a shot. It’s the kind of tool that makes you go, “Why didn’t I switch sooner?”

Wrapping It Up… or Not

Man, the more I dig into Solana’s validator landscape and how wallets like Solflare handle SPL tokens, the more I realize this ecosystem isn’t static—it’s evolving fast. Sometimes in ways that surprise you. Validator selection isn’t just a checkbox; it’s a decision that echoes through network security, your earnings, and even the future of decentralized finance on Solana.

So yeah, I started out thinking staking was simple—lock tokens, get rewards. But now, it feels like picking your team in a season that’s still unfolding. And your wallet? It’s your coach, scout, and playbook all rolled into one.

Anyway, if you’re serious about playing smart in the Solana space, don’t just settle for any wallet. Try tools that give you real insights and control—like Solflare. And if you haven’t yet, the solflare wallet download is just a click away. You might find it changes how you see crypto wallets altogether.

Frequently Asked Questions

What are SPL tokens and why do they matter?

SPL tokens are Solana’s version of fungible tokens, similar to Ethereum’s ERC-20. They enable a wide range of DeFi activities, including staking, liquidity provision, and governance. Managing them efficiently in your wallet is crucial for seamless interaction with the Solana ecosystem.

How does validator selection affect my staking rewards?

Your validator’s performance—uptime, commission, reliability—directly impacts your rewards. Choosing a validator that frequently goes offline or charges high fees can significantly reduce your earnings. Wallets that provide detailed validator stats help you make better-informed decisions.

Is Solflare safe for staking and managing SPL tokens?

Solflare offers robust security features, including hardware wallet support and encrypted seed storage. While no system is foolproof, many users find it a trustworthy and user-friendly option for managing staking and SPL tokens on Solana.

Leave a Reply